The end of dieting: WeightWatchers and Noom are now pushing Ozempic-like miracle drugs over willpower

Sixty years ago, a Queens housewife turned a humiliating fat-shaming encounter into a weight-loss empire. Jean Nidetch was a former IRS clerk and mother of two who had struggled with disordered eating her entire life, and who weighed 214 pounds when she ran into a neighbor at the grocery store. The neighbor assumed Nidetch was pregnant—she wasn’t—and asked about her due date. Nidetch fled the scene, embarrassed but also galvanized: She would go on to lose 72 pounds, and to start WeightWatchers, a business that would sell her advice for doing so to millions of U.S. women.

Over the next six decades, the company would thrive by preaching Nidetch’s basic gospel: Watch what you eat (by counting calories or, in WeightWatchers’ variation, points) and find community support (by paying a monthly membership fee to attend regular meetings with other WeightWatchers customers). That “behavioral” approach to weight loss would go on to power Nidetch’s company through a 1978 sale to Heinz, a 2001 IPO, and a 2015 investment of $43.2 million from Oprah Winfrey (who remains on the board). Even as its profits and stock price yo-yoed over its lifetime, WeightWatchers continued shaping the core of the $80 billion weight-loss industry—outlasting countless dieting fads, a larger cultural shift towards body positivity, some ill-fated internal pivots, and the rise of younger, techier competitors.

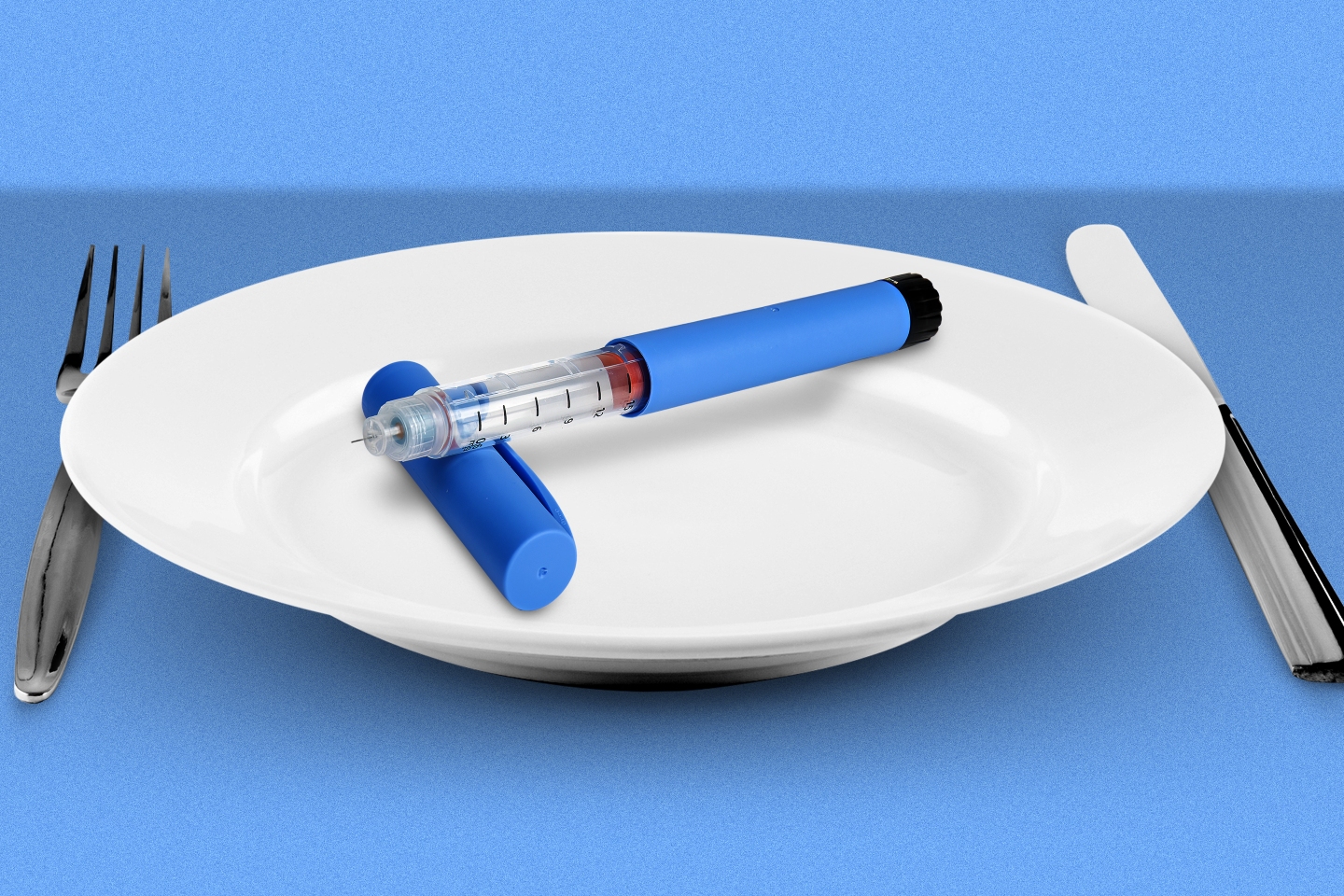

But can it survive the death of dieting? In the past few years, Ozempic, Wegovy, and other so-called “miracle” drugs designed to address diabetes and obesity have revolutionized the business of cosmetic weight loss. The effectiveness and popularity of these new medications, sometimes known collectively as GLP-1s, have redefined the medical treatment of—and at least some societal attitudes towards—fatness and obesity. They also highlight just how ineffective many of the for-profit dieting industry’s products have been, for decades.

“I’ve been a chronic dieter my entire life. I’ve lived pretty much every diet program you can imagine. And I’ve been very successful on WeightWatchers—but the issue is, when you make a change or you stop, you regain the weight,” says Susan Chappell, a 48-year-old banking industry professional in North Carolina, who says a genetic predisposition towards diabetes and obesity started affecting her health as a teenager.

Strangely enough, WeightWatchers arranged for Chappell to speak with Fortune—because she has a much more enthusiastic endorsement of its new line of business. Last August, Chappell joined a telehealth platform called Sequence for a monthly subscription fee of $99. Within days, she was able to virtually meet with a Sequence physician, provide her bloodwork and 2020 diagnosis of Type 2 diabetes, and get a prescription for Mounjaro, Eli Lilly’s GLP-1 treatment for diabetes. Since then, Chappell has lost 65 pounds by taking weekly shots of Mounjaro—which, much like her old methods, she also expects to need for the rest of her life to keep the weight off. Still, her now-common health outcome helps explain why, in March, WeightWatchers agreed to buy Sequence for $106 million.

“We’re admitting that we’re learning; that the science has evolved—and therefore we should, as well,” WeightWatchers CEO Sima Sistani tells Fortune.

WeightWatchers isn’t the only traditional dieting company swept up in the Ozempic frenzy. Startup competitor Noom became a pandemic darling by selling what it calls a “scientifically proven, psychology-based” weight-loss method—which includes counting calories and paying for online support groups—before its rumored IPO appeared to stall. Now it, too, has embraced GLP-1s. In May, the startup officially unveiled its Noom Med platform, which also allows paying subscribers to seek prescriptions from online doctors. That same month, as if to underline the impending doom for diet companies that don’t embrace the new drugs, 40-year-old Jenny Craig shut its doors. (This month, Nutrisystem parent Wellful said it had purchased Jenny Craig’s intellectual property and would be rebooting the brand online—without its expensive retail storefronts—this fall.)

“These medications are a huge threat to the industry, and they’re likely going to take a lot of share going forward,” says Alex Fuhrman, a senior research analyst at investment bank Craig-Hallum. He adds that WeightWatchers and Noom realize they “can’t just sit on the sidelines.”

The new era of far more effective—if more expensive, and often much less accessible—medications for weight-loss treatment raises plenty of complicated questions about the future of dieting and medicine in America. Now this post-Ozempic reality poses a particular existential crisis for the for-profit weight-loss companies that have made billions of dollars, for decades, by telling their customers to have more willpower.

Executives at WeightWatchers and Noom argue that their new telehealth businesses are product expansions more than pivots. Not all of their customers will medically qualify for GLP-1 prescriptions, they say, adding that their traditional diet and lifestyle advice will continue to supplement the prescription shots they’re now selling. Chappell, for example, says she will continue using WeightWatchers’ recipes and advice on what to order at restaurants, and that the company’s past advice instilled personal “accountability” for her eating and lifestyle decisions.

On a larger scale, these business shifts also seem to be helping the companies expand while they continue cutting costs: Noom has laid off hundreds of employees, at least, in the last 18 months, even as it was building Noom Med. WeightWatchers in May told investors it would continue “restructuring” this year. (The company, which had 18,000 employees in 2016, ended 2022 with 7,100 workers.) But what’s bad for laid-off workers is often cheered by Wall Street. And indeed, weight-loss industry executives argue that their prescription pivots are positive almost all around: for the companies and their investors, of course, but also for the customers who can now benefit from increased access to Ozempic, Wegovy, Mounjaro, and their ilk; and perhaps, even, for society at large.

“This is a very welcome change,” says Dr. Linda Anegawa, Noom’s chief medical officer. She adds that, as society’s perception of obesity is (somewhat) shifting from personal, moral failing to chronic disease, “I think, and I hope, that we’re probably looking at the demise of dieting.”

What’s the best diet? All are inefficient

Could we be so lucky? Dieting is tedious, emotionally fraught, subject to all kinds of external judgment, and hard. WeightWatchers, for example, is rooted in “a sometimes out-of-date model for self-transformation that manages to be painfully boring while also requiring a Herculean amount of willpower,” writes Marisa Meltzer in her 2020 Nidetch biography, This Is Big: How the Founder of Weight Watchers Changed the World—and Me.

Dieting is also just not that effective on average—often through no fault of the dieter. Studies have shown that diet and exercise alone can’t compensate for genetic and socioeconomic conditions that affect a person’s weight. The average dieter regains more than 80% of lost weight within five years, according to one meta-analysis of 29 long-term weight-loss studies. And a 2018 study also found that diet, exercise, and behavioral counseling help patients only lose an average of 5% to 10% of their body weight. In contrast, Ozempic and Wegovy melt away up to 15% of body weight.

The diet industry’s for-profit message to potential customers becomes, “If you just do this—track your points or go to a group or eat the prepackaged foods or, frankly, take a shot or a pill—then this is going to finally solve your problem,” says Dr. Scott Kahan, director of the National Center for Weight and Wellness and an author of the 2018 study, who has been a paid adviser to WeightWatchers. “It’s a good business message. But it’s not a very good clinical strategy.”

As a result, dieting companies have long been the subject of widespread, and often well-deserved, societal criticism. Fundamentally, these companies profit from people, especially women, who feel bad—and who have been made to feel bad, by loved ones and colleagues and doctors and society at large—about how they look.

“The underlying principle of this industry for decades and decades has been about morality and willpower, and the individual will to have a ‘better body,’” says Natalia Mehlman Petrzela, an associate professor of history at the New School and author of Fit Nation: The Gains and Pains of America’s Exercise Obsession. “It’s constantly telling people, ‘All you have to do is put in the work—and our products will help you do that.’”

Many people do want to put in the work, however futile the average outcome. Somehow the diet industry has turned a fundamental product flaw—the long-term ineffectiveness of any weight-loss scheme—into a nonstop opportunity to sell new fads, fasts, food products, and fitness trends.

It’s the ultimate recurring revenue model—and, on an industry-wide level, it’s worked pretty well! The U.S. weight-loss industry is on track to make more than $80 billion in 2023, thanks in part to prescriptions for the new drugs, according to the market research firm Marketdata. Despite a dip during the pandemic, the weight-loss industry is 20% larger than it was a decade ago, Marketdata estimates.

Ozempic's still-unknown long-term side effects

In recent years, the fat acceptance and "body positivity" movements have increased awareness of, or at least rhetoric around, standards for beauty and health that don't revolve around being thin. But critics of the diet industry fear that the Ozempic era is already causing a backslide—and even increasing the stigma and discrimination against fat people. "The fervor around it has made it harder to be fat … because if you didn't want to be discriminated against, you could have taken the ‘miracle drug,’” says Tigress Osborn, executive director of the National Association to Advance Fat Acceptance.

Osborn invokes the weight-loss industry’s botched embrace of its previous “miracle drug,” fen-phen—which was effectively withdrawn from sale in 1997 after a year on the market for being linked to sometimes-fatal heart problems—and raises concerns about the still-unknown lifetime side effects of taking GLP-1 medications. (A spokesperson for Novo Nordisk, which makes Ozempic and Wegovy, declined to comment; a spokesperson for Eli Lilly, which makes Mounjaro, did not respond to a request for comment.) The known side effects of most GLP-1s are unpleasant but less life-threatening: diarrhea, nausea, vomiting.

“These drugs worry me deeply,” Osborn says. “And having household [dieting] brands get involved in the distribution of them feels really dangerous, because it really normalizes them.”

'Miracle drugs' to the corporate rescue

Obesity doctors and financial analysts focus on other concerns about how WeightWatchers and Noom will practically make this normalization work. Both companies need to overcome long-standing business and financial problems as they reshape their strategies: Sistani, who took over WeightWatchers in 2022, inherited nearly $1.5 billion in debt and revenues that have been shrinking for years, in part after an ill-fated earlier pivot. In 2018, at the height of the body-positivity era, the company de-emphasized dieting in favor of “wellness,” even dropping the “Weight” from its name and rebranding as WW International.

It didn’t really work: Within two years, the company’s profits were lower than they had been pre-pivot, and then the pandemic ate into WeightWatchers’ in-person businesses. The company ended its fiscal 2022 year with 3.5 million subscribers, down 14.9% from a year earlier, and revenues fell 14.2% over the same period. Now Sistani is trying to bring the company back to dieting basics just as those “basics” are, again, changing.

“I understand that ‘WeightWatchers’ in this day and age might not resonate with everybody, but I think the onus is on us to retake the word ‘diet,’” she says. “Watching your weight is one metric, amongst others, of helping somebody think about their health and having optimal well being.”

Meanwhile Noom, which was privately valued at $3.7 billion in 2021, reportedly hired investment bankers that year but has yet to go public. The company says its app has helped “millions of people lose weight,” but a spokesperson declined to share the size of its current active user base. Noom has laid off hundreds of employees since last April, and in October announced that it was seeking a CEO replacement for co-founder Saeju Jeong. Last week, Noom finally found one: Geoff Cook, previously the CEO and co-founder of online dating company the Meet Group.

“We're not looking for some kind of instant profit” from Noom Med, Anegawa says, arguing that the company’s existing “personalized psychological tools” differentiates it from other telehealth providers who are "jumping into this space just to issue prescriptions for a fee.”

But, as she acknowledges, the competitive landscape is indeed fierce for WeightWatchers and Noom. Dozens of telehealth startups are offering similar online prescriptions for people who want to lose weight using drugs that are in short supply, often not covered by insurance, and in many cases not even approved by the FDA for weight-loss purposes. Ozempic, for example, was approved for the treatment of Type 2 diabetes; while many doctors do prescribe it and other medications for “off-label” purposes, insurance companies often don't cover it for those reasons. A monthly supply of Ozempic can cost around $1,000 without insurance.

According to Sistani, Sequence was a particularly attractive acquisition because it claims to have solved the insurance piece of this puzzle. Its engineers have put “insurance on tech rails,” simplifying the approvals process for patients to get coverage for these expensive and in-demand drugs, she says. Chappell, the Sequence patient, said it took her four days to get insurance approval for her Mounjaro prescription. But analysts and doctors alike question whether Sequence’s technology can, long-term and at scale, really overcome the powerful health-insurance industry’s infamous ability to refuse to pay for any sort of treatment it deems too expensive. As Dr. Nisha Patel, director of an obesity medicine clinic in San Francisco, puts it: Trying to get insurance companies to cover GLP-1 drugs "has been like crawling through barbed wire."

'The end of diet culture'

Investors, at least, seem optimistic that Sistani can pull off WeightWatchers’ latest pivot. The company’s shares have more than doubled, to about $8, since it announced the Sequence acquisition in March.

“If the weight loss companies are effective in their marketing strategies, they should be able to become dominant, because they integrate a lifestyle and diet program along with the drugs,” says Linda Bolton Weiser, a managing director at D.A. Davidson who covers WeightWatchers and its industry.

Sistani acknowledges that she has a lot of careful work ahead, if she’s going to guide WeightWatchers into the post-diet era. “I do see this as the end of diet culture. The focus has shifted from weight loss to weight health,” she argues, before adding: “But I want to be clear that the way you achieve it is through weight loss.”

That new spin on very old rhetoric would have probably resonated with Jean Nidetch, who spent the rest of her life keeping off the 72 pounds she lost—and proselytizing about the diet she turned into WeightWatchers. Fundamentally, her company’s embrace of the new weight-loss drugs is “just an additional way to make money and find new customers,” says Meltzer, Nidetch’s biographer.

“I don't think this is going to eliminate the need for a diet industry,” she adds. “If anything, it could just make it bigger.”